In that dedication to goodness financial realities can seem insignificant.

By Jack Cumming

New residents in CCRCs typically experience a period of euphoria as they meet new friends and discover the freedom that comes with “included service”. No longer do they have to shop for groceries or prepare meals. Dinner in the dining room is a wonderful time to get to know fellow residents. Is the toilet running? Just call Maintenance. And then, there’s the peace of mind that comes from knowing that care is on standby just in case.

A Beacon of Goodness

Senior housing is an industry from which “goodness” shines forth like a beacon as a guide for other industries to learn from. It is an industry dedicated to sustaining people through life’s most difficult transitions from productive living through the inevitable transformation of the living into life’s aftermath, lives completed as inspiration for those who come after.

In that dedication to goodness financial realities can seem insignificant. Residents love what they experience after move-in and trust their providers to be tending to those realities.

It’s a wonderful life, and it’s only normal that residents are enthusiastic. A few may look at the finances and those in the know may be troubled if they discover a negative net asset position.

No, that’s not the norm…

…but many CCRCs operate with a negative net asset position on the balance sheet. It’s a business axiom that the more positive the balance sheet, i.e. the greater the excess of assets over liabilities, the stronger the finances. Others, though, within the senior housing industry and, especially among tax-exempts, argue that negative net assets are no more than an accounting technicality that shouldn’t concern residents.

A Greater Good

It’s a privilege to serve in a cause greater than oneself, and those who serve the elderly in our society are called to such a cause. For the best who serve, their work becomes much more than just a job. It’s only natural that they want to give all people, regardless of finances or the ability to pay, the benefits of their service.

One unnamed, though prominent, commentator responded recently to a resident who enthused about the CCRC lifestyle, but who questioned negative net assets:

You said, “I knew I wanted the CCRC lifestyle.” Imagine if a person looking for a Life Plan Community didn’t understand the meaning and implications (or lack of) of negative assets? That person might end up limiting their own choices based on an unfounded fear or misunderstanding.

Financial Controversy

While I would argue that, if accounting has any meaning at all, a negative net asset position is adverse, there are many in senior positions in the industry like the unnamed commentator who disagree. The result is that an audit report showing a negative net asset balance sheet has emerged as a matter of controversy.

The first prong of controversy is a widespread belief that today’s senior housing GAAP accounting does not result in a true picture of the economic position of an enterprise. That’s a concerning statement. Some believe that if real estate were marked to market, then the appreciation in the real estate would suffice to offset the negative net asset position.

That’s a premise that can be quantified and disclosed. Anything – assets or liabilities – that prevents GAAP from giving a true picture should likewise be quantified and disclosed. If accounting isn’t providing a true financial picture, it’s desirable to supplement it so that the true picture is evident.

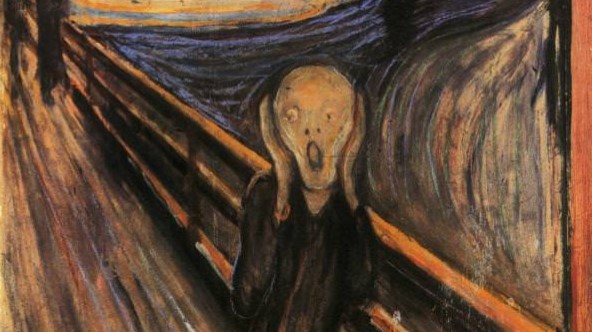

Others argue that a senior housing enterprise, under the “going concern” premise of accounting, should be expected to endure forever, a perpetual enterprise. The corollary of that premise is that deferred promises never need be funded since there will always be a cascade of future customers paying upfront fees to meet current needs. Charles Ponzi (pictured here at work in 1920) gave his name to such optimistic hopes.

The most common reason used to justify a negative net asset position though is a belief that the cause is greater than mere money. This reasoning dismisses accounting concerns as technicalities. The result is a widespread acceptance of the notion that as long as cash is available to cover debt obligations, deferred promises made to residents are secondary and will be met somehow from future operations. It’s an optimistic belief that the future will take care of itself. Sometimes it does, and sometimes it doesn’t.

Prudence – The Big Challenge

The challenge for senior housing is the natural tension between affordability and financial integrity. Not everyone can afford the high cost of residence in a continuing care retirement community. The solution, though, isn’t to underprice that residential experience, hoping that belief in perpetual operation can justify the use of entrance fee proceeds to cover current costs. Better is to manage such funds to cover the lifelong commitments for which they are paid.

As one industry leader put it when justifying such practices, “We don’t ever expect to turn out the lights. And in any event, if it happens, it’s going to happen long after these bonds have come off the market. And the argument, therefore, is irrelevant.”

When you deposit your money for safekeeping in a bank, you don’t expect the bank to spend it on current costs, expecting that future depositors will come along to pay you what the bank owes you. The most astute senior housing operators know that can’t be the premise for senior housing either.

Typically, residents don’t want to spend money for financial soundness, though they are perplexed when financial failure is the consequence. Finances involve astute judgment and the more a business involves trust relationships, as does senior housing with the vulnerable population it serves, the more financial prudence is called for.

The controversy surrounding accounting, the use of entrance fees, and the tolerance for negative net assets detracts from our shared vision. The thoughtful residents’ dream is the same as that of thoughtful providers. We both seek a sound industry – trustworthy in its stewardship – and dedicated to the amelioration of the challenges of age. That’s a noble cause. And we can be unified and noble in its pursuit.