By Jack Cumming

Earlier this month, a friend posed a sports question. Specifically, the question was: “What is your favorite sport and team, and why? What are your favorite sports memories?” For me, the quick and easy answer might be skiing, followed closely by football as a spectator sport. The more truthful answer, though, is that my favorite sport is the competitive world of business.

Business and Government

What I love about business is its potential to make the world a better place. Of course, some may counter that good government also has that potential, and I suppose that it does. The drawback is that government requires a consensus, or at least some kind of majority, before it can work its powerful and coercive magic. Plus, there’s always that potential that the levers of government may fall into the “wrong” hands.

That’s why I hold true to a love of the power of private enterprise to act quickly and to offer change. I prefer government as the referee rather than as both referee and player.

If, then, business is the primary engine for innovation, the test of innovation is whether it resonates with people. If Amazon hadn’t been able to please shoppers in a way that conventional retailing couldn’t, Amazon would still be no more than a glimmer in the mind of Jeff Bezos.

Two Approaches

There are two sides to the sport of business. The most fun is to be the innovator. Not everyone is cut out to be an entrepreneur. Entrepreneurs are creative people who get a thrill from the adrenaline rush of risking a vision and pursuing it.

The other side of business is investing. That, too, entails risk. The truth is that risk can’t be avoided. Sitting on a pile of cash is also risky. That horde of cash (even days on hand) quickly loses value if inflation robs currency of its worth. In the extreme, as occurred in Germany 100 years ago, cash can lose all its value and become worth no more than the paper it’s printed on.

My Moments

I’ve had the fun of playing both sides of the game. It’s true that I was never an entrepreneur in the way that Jeff Bezos or Elon Musk is, but I was able to manage an independent, profit-centered business within a large corporation.

My takeaway from that is that entrepreneurship, no matter how successful, will seldom flourish within the politics of an established corporate structure. The new always threatens the old. Resisting threats (innovation) is the stuff of corporate politics.

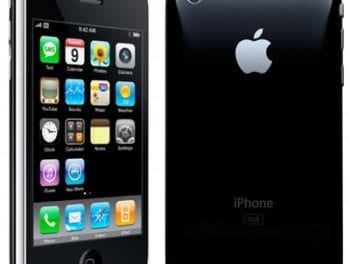

When I was the innovator, the challenge was the threat that moving to personal computers presented to the corporately entrenched mainframe computer interests. Today, I suppose the same would be true of the threat that artificial intelligence aficionados pose to many equally entrenched corporate technology establishments.

After leaving corporate life, I became a consultant. That, too, was fun, but my work enriched others, not me. I never took the leap to start a business from scratch. I wish I had.

A Big Bet

Thus it was that with time I was forced to discover the adventurous sport of investing. The reason was simple. I was 55 years old, and the specter of retirement was looming. A quick calculation showed that I was short about half of what I should have had at that stage of the game.

It was clear that it would take risk to make up the shortfall. Risk, in the case of investing, can mean concentrating on one business just as one concentrates on a single business in accepting a job. Concentration is the opposite of the much-counseled diversification.

For that investment, I looked for a firm on whose “team” I would be happy to play, one with a high-minded CEO (the coach) with vision and a reputation for getting things done. The corporate purpose of the team I found was to connect people globally on the premise that people who know each other are less likely to go to war. No, it wasn’t Facebook, but the investment did pay off.

My goal was just to have enough. With that goal met, after listening to Jack Bogle, my wife and I went with index fund investing. I still far prefer business as a spectator sport than I do any other kind of distracting amusement. And investing in the stock market is all the gambling sport I’ll ever need.