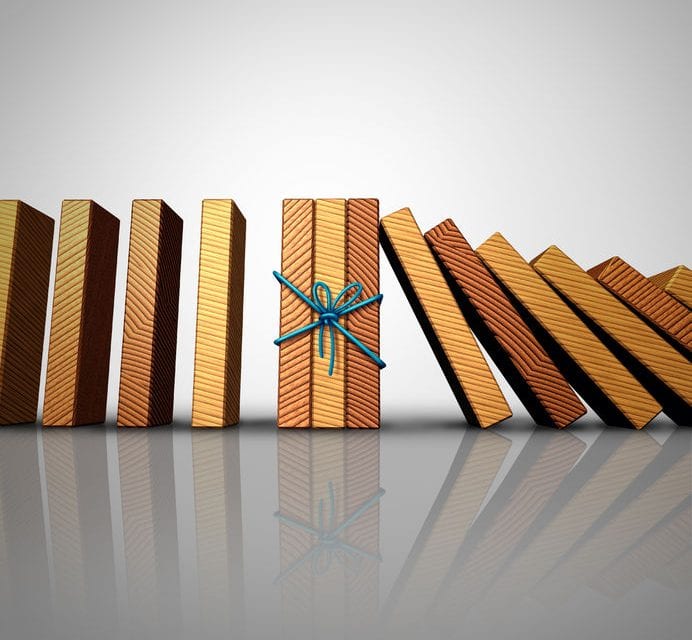

Leadership lessons I see for every single operator.

By Steve Moran

A few days ago, we published an article titled “The Malingering Collapse of Air Force Village West“where I provided an overview of what went wrong at what was at one time a model community of success. There may be some prurient spectator value in publishing a sorrowful story like this, but we are ultimately committed to using stories like this as vehicles for learning . . . not just to avoid mistakes but to actually excel.

The Lessons

Here are the lessons I see for every single operator:

-

Watch for Signs of Distress — I was never an insider but I guarantee there were early warning signs that could have alerted management and the board to impending danger. A trend toward lower occupancies; spending a lot more money to maintain occupancy; the first time they dipped into reserves.

-

Maintain and Upgrade Your Properties — It has been a very long time since I have been on the campus of Altavita, but everyone I have talked to says it is tired and needs some serious TLC. My sense is the bones are fine, but the finishes are not.

-

Make Sure Your World Includes Curmudgeons (and Listen to Them) — It is a ton more fun to have a board that follows the lead of management or the board chair. It is just not a very good way to create a sustainable enterprise. You need folks who ask tough questions, who wonder if assumptions are right.

That is not to say you need someone who is not fundamentally supportive of the mission of the organization. It is possible to do both. It is largely the role I play on the board of Abe’s Garden.

-

Assume Status Quo Does Not Exist — If it does exist it is not good enough. Maybe more than anything else, I suspect the board and management thought things would always be as good as they were in the beginning. The right way to look at things, no matter how good they are is to assume things can be better than they are — that you have room for improvement.

-

Look for Threats and Opportunities — I find myself wondering what it would have been like if they had early on realized that maybe there were not enough retired military officers to keep filling apartments. What if they started thinking about new ways to leverage their assets? This story did not have to be what it is.

The Future

We will be watching to see what the “rest of the story” looks like. Here are the things we are wondering:

-

Will the new potential purchaser find enough value to make a big investment?

-

Will the debt holder decide there is enough value in the land and buildings that they will put the community into receivership?

-

Will the debt holder have to give up something?

-

Will the residents be made whole with respect to their initial payments and monthly payments or will they be forced to lose principal or face increased fees?

-

Is it possible the debt holder could decide senior living is not the highest and best use for the land, foreclose and move everyone out (just a possibility, at this point it seems unlikely though particularly given the Department of Defense deed restrictions)?

-

Will the State of California do more, or will the Department of Defense get involved at all?

The worst part of all of this is that individuals choose the CCRC/Life Plan model of living because it comes with or is supposed to come with a high degree of certainty. It is the model that planners prefer and what has happened is anything but that.