By Steve Moran

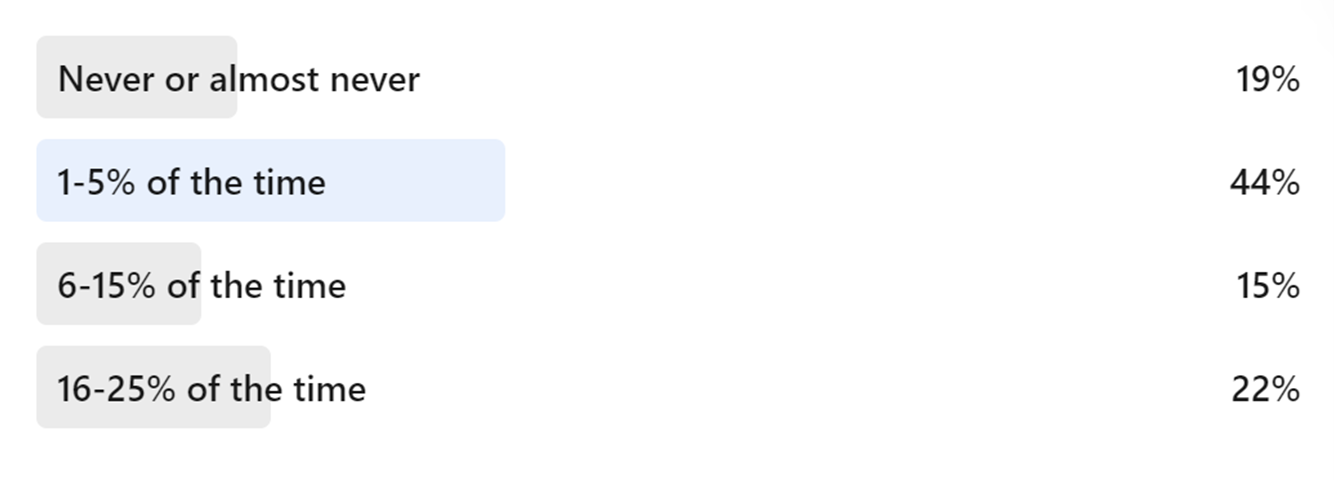

Recently I ran a poll on LinkedIn where I asked about the percentage of time a prospect needed to sell their home before moving in. Here are the results.

If you are in the “Never or almost never” category this post is not for you. If you are in the other 81% (most of you) keep reading.

I was recently talking to Elias Papsavvas the founder of Second Act Financial Services (a Foresight partner), an organization that is solely focused on this challenge by providing short-term bridge financing until the home is sold.

He points out that when you have a prospect that needs to sell their house before moving in, one of two things happens 98% of the time.

- It delays the move-in by weeks and months, which means residents are not getting the kind of lifestyle they need and the community loses out on valuable revenue.

- In some cases, residents will simply not move into your community or any community. This means a poorer quality of life for residents and a substantial loss of income to the community.

This does not count the hassle families and residents face when they have to sell the family home “fast”. All that stuff, maybe losing value. It is all around a tough situation.

A Story … Solving The Move-In Problem

Elias has deep experience solving this problem. This is a powerful story of what can be from when he was working with another organization doing a similar thing.

They had something like 800 communities they were serving. Their message to these communities was simple.

“On average, you will get 30-40 who want to move into your community over the course of a year and we will not be able to help most of them. But there will be 5-10 that are simply stuck until they sell their house. Those are the people we can help get unstuck.”

And even though it was clear there was a need and a solution somehow, the salespeople were not making it all happen. Salespeople would be saying they couldn’t hit their numbers because people were not able to sell their homes and yet they were not reaching out to take advantage of these short-term loans.

Elias hit the road to figure out where the disconnect was.

Over and over again he heard the same story it went something like this:

“Sally, help me to understand what’s going on. Obviously, your families have issues with paying for their care and yet they never call us.”

At first it was silence and then she started crying because she was afraid of being fired, she was scared because she had bills to pay. Then she blurts out … “I didn’t sign up to talk to people about money and loans. I am doing this because I want to help people.”

Other industries, cars in particular, know that salespeople are not good at talking about financing and loans which is why they have separate finance departments with experts who know how to do this.

What they did was create a simple system where, with every single prospect, they would give them a resource package that would say something like “we know some people need to sell a home in order to move in. One of the ways to speed that process is to talk to this company and they can help you figure out the right solution for you.”

When they did this their sales jumped massively. Occupancy went up, salespeople started hitting their numbers, and more older people were able to live out their best lives.

Second Act Financial can do this for you. Reach out to Second Act Financial Services at [email protected] or find out more at secondact.com.