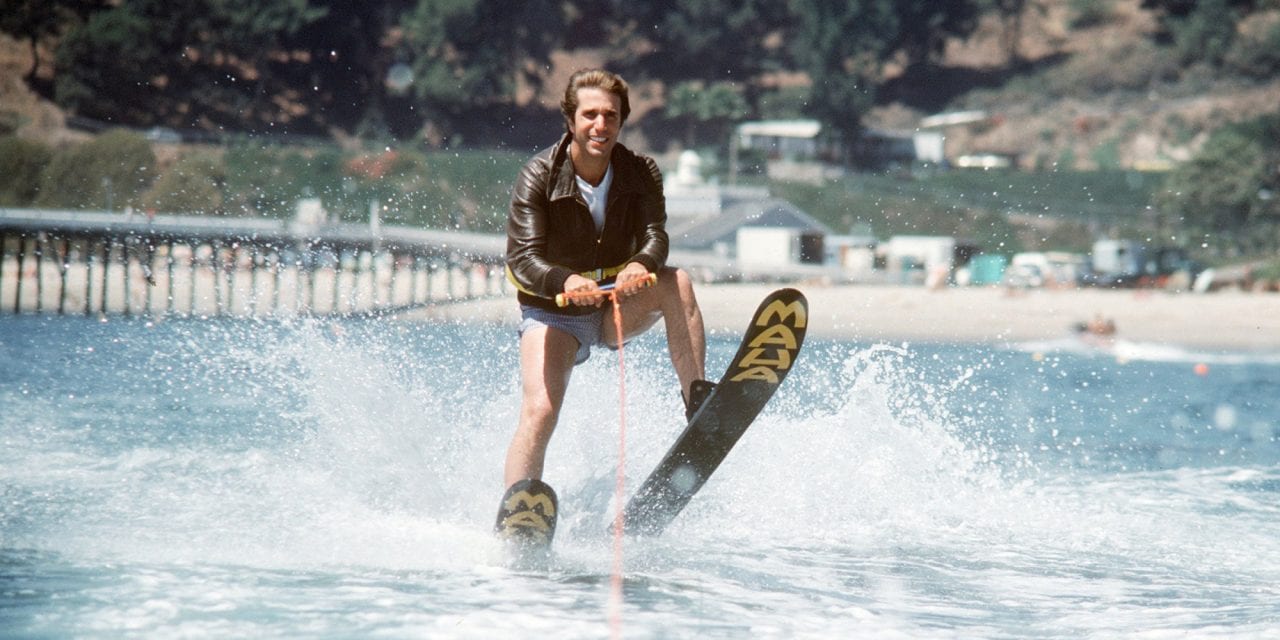

Jump the Shark is a pop culture reference to an episode of Happy Days where “The Fonze” was waterskiing and jumped over a shark. It was such a terrible episode that it marked the beginning of the end of the show.

By Steve Moran

In case you didn’t know . . . “Jump the Shark” is a pop culture reference to an episode of Happy Days where “The Fonze” was waterskiing and jumped over a shark. It was such a terrible episode that it marked the beginning of the end of the show.

On Thursday evening, Kandi Short on my team Skyped a link from forbes.com asking “Have you seen this?” I hadn’t.

The article title: Chinese Investor To Grab $2B Worth of U.S. Senior Housing Properties. Pretty fascinating given the declining occupancy rates and likelihood of interest rate increases.

The Article

It is a very short article but the gist of it is this:

-

Cindat, a capital management company based in Beijing, is apparently going to make a $2 billion dollar wager investment on senior living.

-

The CEO Greg Peng believes senior housing is “the one U.S. sector that is not overbuilt.”

-

“He expects demand to soar over the next 10 years.”

-

He seems to believe that as Americans reach age 70 they will be ready for senior living in droves.

-

He is looking at making 2, one-billion dollar investments.

Arghh

It hardly feels like I need to comment any further. “Not over built”, “Age 70 and ready for senior living.” It is hard to know where this comes from . . . Maybe someone who wants to sell them . . .

Back in the late 80s and into early 90s Japanese investors had an incredible appetite for US real estate. Their appetite for purchasing US real estate caused prices to soar. By 1992 things started going south in a big way. Prices plummeted and much of the ownership was repatriated (thinking that might be a politically incorrect term, but at the time, there was a great deal of nervousness about the level of Japanese ownership.)

If this investment happens . . .

-

It is likely to be a spectacular win for sellers.

-

It will make new acquisitions by traditional owners and operators extremely difficult.

-

It will be hard on the industry, residents, families and team members because of unrealistic investor expectations.

-

In the long-term it will be great for the US economy because it will bring home hundreds of millions of U.S, Dollars.

The roller coaster ride has just begun.